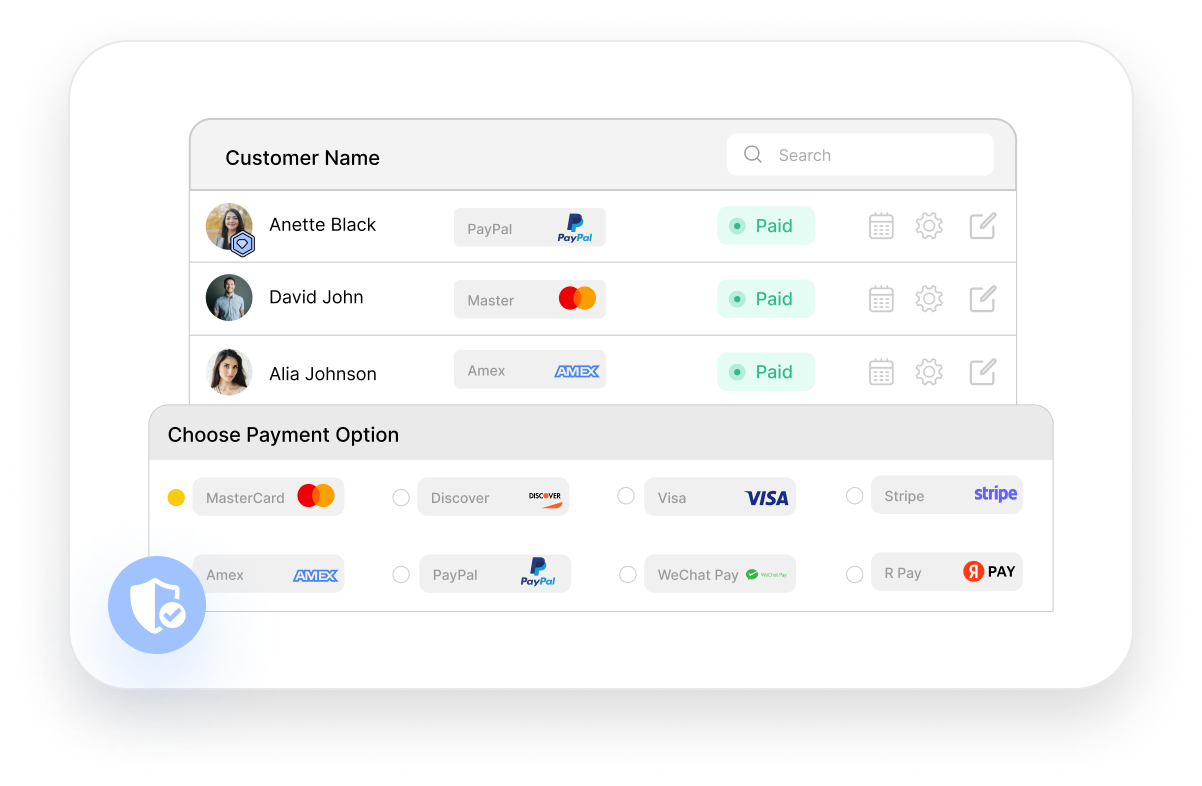

Payment processing software plays a vital role in modern business operations. These tools streamline financial transactions, improve security, and provide valuable insights into cash flow and customer behavior. Advanced payment processing systems offer multi-channel support, allowing businesses to accept payments through various methods including in-store terminals, online platforms, and mobile devices. This flexibility enhances customer experience and opens up new revenue streams.

Integration capabilities are crucial for maximizing the value of payment processing software. These systems often connect seamlessly with accounting software, CRM platforms, and inventory management tools, creating a cohesive financial ecosystem.

Real-time reporting and analytics features provide businesses with immediate insights into transaction volumes, success rates, and revenue patterns. This data empowers decision-makers to identify trends, optimize pricing strategies, and improve overall financial performance.

For businesses operating internationally, advanced payment processing software offers support for multiple currencies and region-specific payment methods. This global capability simplifies expansion into new markets and improves the customer experience for international clients.

Automated reconciliation is another key feature, reducing manual data entry and the potential for errors. This not only saves time but also improves the accuracy of financial records.

As the digital payment landscape evolves, leading payment processing software continues to adapt, incorporating new technologies like contactless payments and blockchain to meet changing consumer preferences and business needs. Ultimately, robust payment processing software is more than just a tool for handling transactions. It’s a strategic asset that can drive business growth, enhance customer satisfaction, and provide a competitive edge in an increasingly digital marketplace.