If you run a subscription-based biz, then you know the struggle is real when it comes to chasing down those missed payments. It’s not just a pain in the neck; each failed payment can really put a damper on your company’s progress. Now, without a good system in place for recurring payments, your team probably spends more time than they should be hunting down late invoices, and that’s money that should be sitting pretty in your bank account just floating off into the ether. So really, it’s time for an upgrade.

Ditching the Headache of Manual Billing

Juggling billing using spreadsheets or trying to do things manually? Trust us; it’s a recipe for frustration.

You could spend hours every month just trying to find out why payments didn’t go through.

You might miss some customers along the way, which, let’s face it, means revenue down the drain.

And when services get interrupted because of billing issues, your customers get annoyed and that’s never good for business.

Switching to automated payments can seriously lighten your load and keep your customers doing a happy dance.

The Hidden Costs of Failed Payments

It might shock you to see just how much revenue can vanish due to those pesky payment declines. The numbers say it’s anywhere from 5% to 10%. Now, for a SaaS company, that’s not chump change; we’re talking potentially thousands, or even millions, gone. What’s usually the culprit? Cards that expire or get replaced, customers who are a little short on funds, or banks that block payments because they’re playing it safe with fraud checks.

But a killer payment system? It does way more than just process transactions – it prevents those losses from happening in the first place.

How Easy Recurring Payment Processing Works

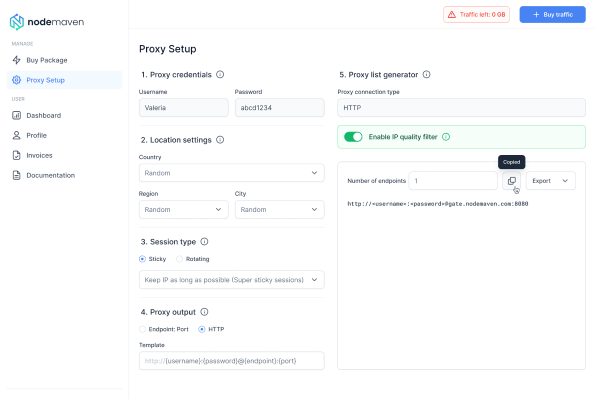

Step 1: Effortless Payment Setup

Your customers can save their preferred payment method – be it a credit card, direct debit, or digital wallet – without pulling their hair out. UniBee plays nice with the big shots like Stripe and PayPal, so getting everything set up is as easy as pie.

Step 2: Billing Cycles on Autopilot

After the payment info is saved, the system takes the reins. You simply choose how often you want to bill – monthly, yearly, whatever floats your boat – and the charges go out automatically. Wave goodbye to manual invoicing.

Step 3: Handling Bumps in the Road with Finesse

Payments don’t always go through the first time around; it’s a fact of life. That’s why UniBee comes armed with a smart recovery system that can:

- Give those failed payments another shot at just the right moments

- Remind your customers to update those expired cards

and help keep subscriptions sailing smoothly while cutting down on cancellations

What to Look For in a Recurring Payment System

Smart Recovery Tools

Not all retry systems are created equal, period. The top-tier ones use data to figure out the best time to try again and when it’s a good idea to reach out to your customers.

Compliance & Tax Handling Built-In

Tackling taxes like VAT or GST manually is like walking a tightrope. The right system will handle all the number crunching for you and stay on top of all the latest rules and regulations.

Crystal Clear Reporting

You should always have a clear view of how your revenue is doing. Real-time dashboards make it a breeze to keep an eye on payment success, churn rates, and overall trends.

Why Businesses Put Their Faith in UniBee

Plays Well with Your Current Tools

UniBee gets along great with Stripe, PayPal, and other processors, so you don’t have to mess with what you already have.

Grows Alongside Your Business

Whether you’re dealing with a handful of payments or thousands, UniBee can handle it all while keeping your data safe and sound.

Getting Ready for the Future of Payments

Support for Going Global

Thinking about expanding internationally? UniBee supports billing in a whole bunch of currencies and payment methods for different areas.

Rock-Solid Protection Against Fraud

Tools that are way advanced help to spot fraud while making sure real, paying customers don’t get blocked by mistake.

Stop revenue loss due to problems which can be solved

Having a reliable recurring payment system isn’t just about simplifying things. It can seriously boost your business. Fewer failed payments translate to more predictable income, happier customers, and less time spent wrestling with billing nightmares.

UniBee is there to help subscription businesses automate payments, recover lost revenue, and put all their focus on future improvement. Want to see how it all comes together? Give it a whirl and experience the difference.